Shipping Terms

For all our shipments, we follow Incoterms 2020 rules. The Incoterms rules are standard sets of trading terms and conditions designed to assist traders when goods are sold and transported. Each Incoterms rule specifies:

- the obligations of each party (e.g. who is responsible for services such as transport, import and export clearance etc.

- the point in the journey where risk transfers from the seller to the buyer

By agreeing on an Incoterms rule, the buyer and seller can achieve a precise understanding of what each party is obliged to do, and where responsibility lies in the event of loss, damage or other mishap. The Incoterms rules are created and published by the International Chamber of Commerce (ICC) and are revised from time to time.

Delivered at Place (DAP), almost all our shipments are Delivered at Place

Can be used for any transport mode, or where there is more than one transport mode.

The seller is responsible for arranging carriage and for delivering the goods, ready for unloading from the arriving conveyance, at the named place. Risk transfers from seller to buyer when the goods are available for unloading, so unloading is at the buyer’s risk.

The buyer is responsible for import clearance and any applicable local taxes or import duties.

Delivered Duty Paid (DDP), shipments within The Netherlands

Can be used for any transport mode, or where there is more than one transport mode.

The seller is responsible for arranging carriage and delivering the goods at the named place, cleared for import and all applicable taxes and duties paid (e.g. VAT, GST). Risk transfers from seller to buyer when the goods are made available to the buyer, ready for unloading from the arriving conveyance.

This rule places the maximum obligation on the seller, and is the only rule that requires the seller to take responsibility for import clearance and payment of taxes and/or import duty. These last requirements can be highly problematical for the seller. In some countries, import clearance procedures are complex and bureaucratic, and so best left to the buyer who has local knowledge.

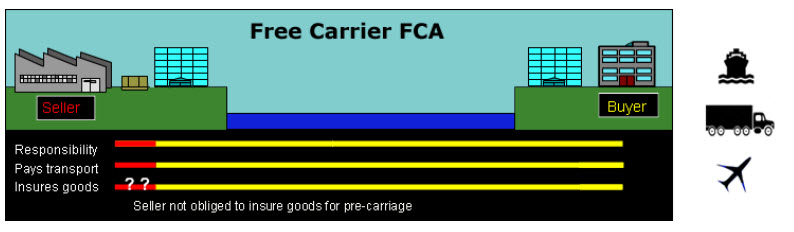

Free Carrier (FCA, Sellers Premises)

The seller delivers the goods, cleared for export, to the agreed common carrier at the seller's own premises. The goods can be delivered to a carrier nominated by the buyer, or to another party nominated by the buyer. The buyer is responsible for import clearance and any applicable local taxes or import duties.

Shipping on own account

In the order process you have the option to ship on your own carrier account.

Please let us know the account number of your logistics partner and we will arrange the shipment.

For more information about Incoterms, please click here.

Free shipment

Qualification for free shipping may depend on destination country, order amount and/or package size and weight.

Please note that availability of shipping methods depends on the destination country.

Please contact our sales departement for options and questions.

Additional charges

For orders under € 200,-- we charge an additional € 25,-- order/handling fee. When applicable, this fee is included in the shipping charges. If you choose to pay in US dollars, the final amount may vary due to currency fluctuations, as the € 25 fee is calculated based on the exchange rate. Shipping charges are calculated in euros and converted to US dollars where applicable.

In non-EU countries there are additional costs because of customs administration costs, taxes and tariffs, some of which may be included in the shipping charges.

* Extra invoice for TPT - Transaction Privilege Tax / Sales Tax - Arizona, USA

For customers in the US state of Arizona Americas, we add a charge for TPT (Arizona Transaction Privilege Tax, currently 8.3%) based on over the price of products/services purchased.

When required, you will receive an extra invoice for TPT.

* Extra invoice for Sec. 301 Import Tariffs

In the case of certain products made in China, there may be additional tariffs incurred when these products are imported into the USA.

For shipments of these products in the US, we pass along these charges for Sec. 301 Import Tariffs to the buyer.

In such cases, you may receive an extra invoice.

Shipment

After we have received your payment, we will try to expedite your shipment as much as possible.

For any questions regarding your order, feel free to contact us via [email protected]. We are happy to assist!